Unlocking Wealth Through Intelligent Real Estate Investment

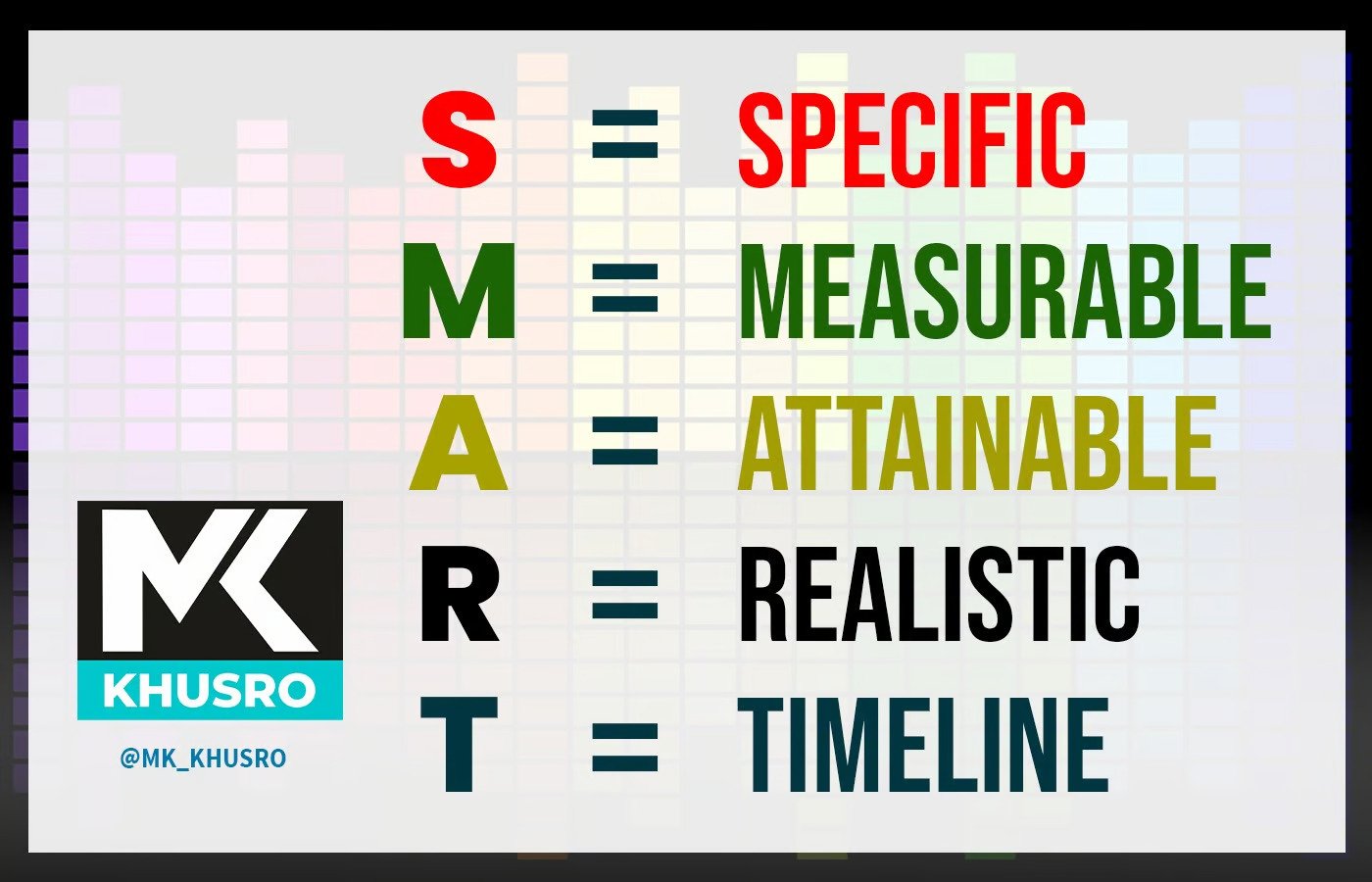

As you embark on your real estate journey, remember the power of the SMART principles. By setting Specific, Measurable, Attainable, Realistic, and Timeline-oriented goals, you'll be better equipped to navigate the complexities of the real estate market. W

2024-07-31 18:39:33

Welcome to the dynamic and promising realm of real estate investing, where strategic planning and a SMART mindset can lead to substantial wealth accumulation. Let's explore in depth the core principles of SMART goal-setting and how they seamlessly integrate into your real estate ventures.

Specific: Define Your Real Estate Goals

Specificity is the cornerstone of effective goal-setting in real estate. Take the time to clearly define your objectives. Are you aiming to cultivate a reliable passive income stream through rental properties, or is your focus on the potentially lucrative practice of flipping houses for quick profits? By articulating your goals with precision, you lay the groundwork for a well-defined roadmap to success.

Consider detailing your desired property types, preferred locations, targeted investment returns, and any specific niche within the real estate market you wish to explore. The more specific and detailed your goals, the clearer your path becomes towards achieving them.

Measurable: Quantify Your Success

To effectively gauge progress and celebrate achievements, it's essential to establish measurable criteria for success. Quantifiable metrics such as the number of properties in your portfolio, rental income generated, or the percentage increase in property value serve as tangible indicators of your success trajectory.

Regularly track and analyze these metrics to ensure you're staying on course and meeting your objectives. Adjust your strategies as needed based on the measured outcomes, ensuring continual progress towards your ultimate real estate goals.

Attainable: Set Realistic Milestones

While ambition is admirable, setting attainable goals is paramount for long-term success in real estate investing. Consider factors such as your financial capacity, prevailing market conditions, and personal resources when establishing milestones along your journey.

Rather than aiming for lofty, unrealistic objectives, focus on setting gradual and achievable milestones that align with your current circumstances and resources. This approach not only fosters a sense of accomplishment as you reach each milestone but also ensures a more sustainable and enjoyable real estate journey.

Also Read : Top 10 Global Real Estate Projects Shaping 2023: A Comprehensive Overview

Realistic: Align with Market Realities

Realism is fundamental in navigating the complexities of the real estate market. Take the time to thoroughly research local market trends, analyze property values, and stay informed about economic factors that may impact your investments.

By aligning your goals and strategies with market realities, you empower yourself to make well-informed decisions with confidence. Acknowledge both the potential rewards and risks associated with real estate investing, allowing for a pragmatic approach that maximizes opportunities while mitigating potential challenges.

Timeline: Establish a Real Estate Investment Timeline

In the fast-paced world of real estate, time is of the essence. Setting a realistic timeline for your goals provides a sense of urgency and helps maintain focus and momentum throughout your investment journey.

Consider establishing both short-term and long-term timelines for your real estate objectives. Whether it's acquiring your first investment property within a year or achieving a specific rental income level within three years, a well-defined timeline serves as a roadmap for progress and keeps you accountable to your aspirations.

SMART Strategies for Real Estate Success:

1. Market Research and Analysis

Before committing to any real estate investment, conduct comprehensive market research and analysis. Identify emerging neighborhoods, analyze property values, and assess demand and supply dynamics within your target market.

Armed with this information, you can make informed decisions about where and when to invest, maximizing your potential returns while minimizing risks. Embrace data-driven insights to guide your investment strategies and capitalize on lucrative opportunities in the market.

2. Financial Planning

Sound financial planning is fundamental to smart real estate investing. Calculate your budget meticulously, factoring in expenses such as property acquisition costs, renovation expenses, and ongoing operational costs.

Collaborate with financial advisors to ensure your investment aligns with your overall financial goals and risk tolerance. By establishing a solid financial foundation, you set yourself up for sustainable success in the real estate market, safeguarding your investments against unforeseen challenges.

3. Diversification

Diversifying your real estate portfolio is a strategic move to mitigate risks and maximize returns. Explore various property types, including residential, commercial, and vacation rentals, to diversify your investment portfolio effectively.

By spreading your investments across different asset classes and geographic locations, you minimize exposure to market fluctuations and enhance the resilience of your investment portfolio. Embrace diversification as a core strategy to optimize returns while safeguarding against potential downturns in specific sectors of the real estate market.

4. Network Building

Networking plays a pivotal role in real estate success, providing access to valuable insights, potential partnerships, and exclusive investment opportunities. Cultivate relationships with real estate professionals, join local real estate groups, and actively participate in industry events and forums.

By expanding your network within the real estate community, you gain access to valuable resources and expertise that can enhance your investment strategies and unlock new opportunities for growth. Prioritize relationship-building as an integral component of your real estate investment journey, leveraging the collective knowledge and experience of your network to drive success.

Conclusion:

As you embark on your real estate journey, remember the transformative power of the SMART principles. By setting Specific, Measurable, Attainable, Realistic, and Timeline-oriented goals, you equip yourself with a structured framework for success in the dynamic and ever-evolving real estate market.

Whether you're a seasoned investor or a newcomer to the world of real estate investing, embracing a SMART approach will empower you to navigate challenges, capitalize on opportunities, and achieve sustainable long-term financial success. With dedication, diligence, and strategic planning, you can build a robust real estate portfolio that serves as a cornerstone of your wealth accumulation journey. Here's to your continued success and prosperity in real estate investing!

Read Also : A Comprehensive Analysis of Real Estate Trends in Indian Union Territories

© 2024 MK Khusro. All rights reserved.